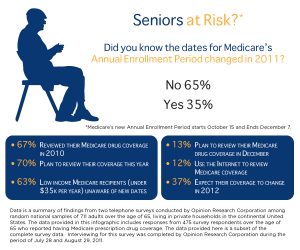

Can I change Medicare Supplement plans at any time? This is a question I get asked a lot. Here is the answer. Yes, you can change your plan at any time. Hi, I am Mitch Winstead from Allstar Senior Benefits. Our toll-free number is 866-598-8170 or 910-452-1922. We give free advice and you are under no obligations if you want a quote. Also, you can change as many times as you want. I don’t recommend that you do change it any more than 2-3 times a year. If it is a Medicare Advantage policy then you cannot change it at any time. You have to wait for what is called AEP or annual enrollment period. That is from October 15th through December 7th each year at the time of this writing. Medicare Supplements are standardized, meaning every Medicare Supplement company that provides plans A-N has to give you the same exact plan.

They will more than likely be able to get you a lower price and the same plan. You do have to qualify by answering some health questions on the new companies application. Each company has its own set of standards on who they will accept and who they won’t accept. For example company, A may not take anyone who is on oxygen. Some companies won’t take a person who takes over 50 units of insulin. These are many examples Some companies have lower rates for smokers. I carry a large number of companies to help people save money. If you talk to a “captive agent” a person who writes with only one company. That person can only give you one option. Because they only write business for one company. Once you do get a rate increase then call your captive agent, you are out of options. An independent agent has options because of the different companies they carry. If one does not work for you then there are different companies available, My recommendation is always to use an independent agent/broker. There are 100 + companies out there that market supplements. So there is always a choice.

Now if you have a health condition that is severe-you may not qualify for a new company. Or you may qualify but you are going to pay a hefty price. Although sometimes that is better than having any insurance at all. We can get ourselves in trouble by not having coverage. If you absolutely can’t afford it, I understand. But for the people who can afford it, it is the responsible thing to do. I am sure you know people that have no health insurance and get sick or in an accident that wished they had insurance. Who wants the collection calls from a doctor’s office or hospital? Plus with coverage, you do have choices. You most likely get better care when you are sick and really need it the most. It is a terrible feeling when you are sick and have to worry about paying medical bills.

Each insurance company could make so many differences that it would be difficult for consumers to understand. Some people think if they pay a higher price for a standardized Medicare Supplement plan that I get more. That is simply not the case. A plan f is a plan f is a plan f. A plan g is a plan g is a plan g. No differences. When I talk to people and I can save them $50 a month they sometimes think-wait a minute. I am not going to get the same plan. Because it’s simply $50 less. Or they think since the company I am quoting for them is not a household name- there is gotta be something wrong somewhere. I don’t want to get ripped off. Because this is my health insurance we are talking about. I understand your concerns. One thing that might set your mind at ease is that you get a 30 day free look period on any Medicare Supplement policy. That means if you look it over for a month and don’t like it, you get your money back. Also, ANY Medicare Supplement policy has to be approved for sale by that state’s Insurance Commissioner. So the Insurance Commissioner goes through the financials of a particular company to make sure it is legitimate and solvent. Not just any company can go into a state and start selling Medicare Supplements with no questions asked.

There is a process. That being said, it does do good to look around and compare prices. I am a broker, I am going to have most companies available to help you select the best one. Let’s talk about the inevitable rate increase. All companies have rate increases. Why because Medicare raises its deductibles each year. The insurance companies, therefore, have to increase rates also to stay in business. There was one company that had agents telling their clients or prospects that our rates won’t increase based on their age. Well, that may be true but the rates go up based on other factors. I have to chuckle a little because some people actually thought they weren’t going to get a rate increase. This is health insurance, you are going to GET a rate increase. My advice is to know its coming and plan for it. You can almost bet on at least a 10% increase. So save 10 dollars each month to prepare. Don’t get shocked and all of a sudden start panicking about an increase. At least that’s my advice.

Some people take and some leave it. This may sound like a poor analogy but say you know a strong thunderstorm is coming and you have your windows open or clothes out on the line. Don’t you say to yourself at some point Hey I better prepare a little and roll my windows up and get my clothes off the line? It’s preparation. You know it’s going to happen its best to be proactive about it. Sometimes a few companies may want to get into the Medicare Supplement business and they may offer great rates. Competition is fierce in this business. That bodes well for the buyer. I think if people started understanding that you can change your Medicare Supplement anytime and the plan is exactly the same then we might see more changes occurring. Some people just don’t like change period. I am with you, I don’t like change.

However, if I can get the same product for a cheaper price then I am usually taking that. It really floors me as a broker when I talk with someone and I am able to save them $30 plus dollars a month and they give me some stupid rejection. They just don’t get it. I say to myself that’s like throwing your money away. I often wonder what happens with these people? Because at some point if they DO NOT change their rate is going to keep going up and up. It’s ridiculous not to stop it. Or do they wait for a few years until it totally gets out of control and decides ok that’s it I am going to make a change now? Look at all the money you wasted. I could go on and on regarding this subject. I think until there are more education and more comprehension by clients that nothing is going to change. I would be happy to talk with you

Sometimes a person can even choose a plan that has one less benefit that their current plan and really save money. It gets exciting once you realize how much you can save. There are a lot of options out there for people. Don’t just settle for the one size fits all approach. Companies are wanting your business. Take advantage of the savings! Hire a broker that has different companies available-not just one. I am so glad to be independent not a captive agent. I have helped many people save money on Medicare Supplements, Part D plans, life insurance, LTC. My strategies work. If you would like to contact me, my toll-free number is 866-598-8170 910-452-1922 or our website https://allstarseniorbenefits.com

Our Facebook page is https://www.facebook.com/medsuppguru

Our email address is mitch@allstarseniorbenefits.com

If you would like a quote with no obligations please visit our quote page by clicking this link https://allstarseniorbenefits.com/get-a-quote/#.W6ktqWhKhPY